United States Veterinary Services Market Challenges & Opportunities 2023-2035

Published Date: Aug 2023 | Report ID: MR1158 | 220 Pages

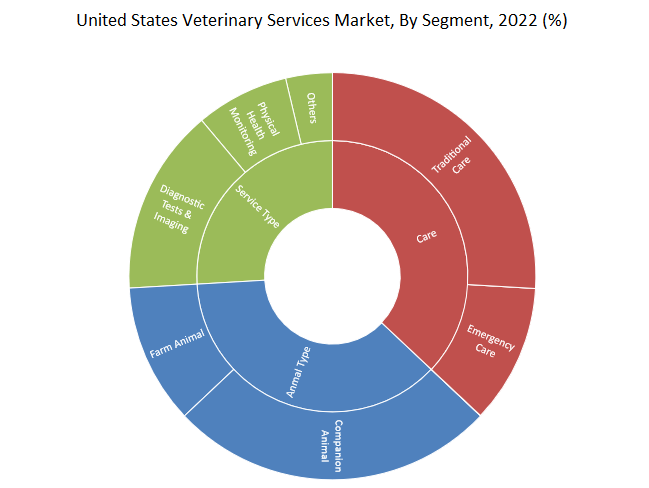

United States Veterinary Services Market Size By Service Type (Diagnostic Tests & Imaging, Physical Health Monitoring, Surgery and Others), Animal Type (Companion Animal, Farm Animal), Care (Traditional Care, Emergency Care), Segmental analysis, Regional Overview, Company share analysis, Leading Company Profiles and Market Forecast, 2023 – 2035

Industry Outlook

The United States Veterinary Services market accounted for USD 21.83 billion in 2022 and is expected to surpass USD 47.92 Billion by 2035, growing at a CAGR of over 6.29% between 2023 and 2035.

Veterinary services refer to a range of medical, diagnostic, and preventive healthcare services provided to animals by trained professionals known as veterinarians. These services are similar to medical services provided to humans, but are specifically focused on the health and well-being of animals.

Report Scope:

| Parameter | Details |

|---|---|

| Base Year | 2022 |

| Market Size in 2022 | USD 21.83 Billion |

| CAGR (2023-2035) | 6.29% |

| Forecast Years | 2023-2035 |

| Historical Data | 2018-2022 |

| Market Size in 2035 | USD 47.92 Billion |

| Countries Covered | United States |

| What We Cover | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PESTLE analysis, value chain analysis, regulatory landscape, pricing analysis by segments and region, company market share analysis, and 10 companies with scope for including additional 15 companies upon request |

| Segments Covered | Service Type, Animal Type, and Care |

To explore in-depth analysis in this report - Request Free Sample Report

The primary goal of veterinary services is to promote and maintain the health of animals. Veterinarians are responsible for diagnosing and treating illnesses and injuries in animals, performing surgeries, prescribing medications, and providing preventive care such as vaccinations, parasite control, and dental care. They also play a crucial role in animal welfare, public health, and the prevention and control of infectious diseases that can affect both animals and humans.

Market Dynamics

The US Veterinary Services market is a rapidly growing market due to the increasing prevalence of various diseases in the animals and growing adoption of pets/companion animals in the United States.

There has been a greater emphasis on spreading awareness about the benefits of pet adoption and the importance of animal welfare in the United States. Animal shelters, rescue organizations, and advocacy groups have been actively promoting adoption as a responsible choice for prospective pet owners. Various adoption campaigns and events have gained popularity across the country. National events like "Clear the Shelters" and local adoption drives have garnered significant media attention, leading to a surge in pet adoptions. With this, the adoption of animals is on the rise across the country which is propelling the demand for veterinary services. As dogs and cats are the most adopted animals in the country, most of the services are related to dogs and cats.

According to the study by BioMed Central Journal published in February 2021, it was observed that several efforts are being taken by the US government to reduce the number of euthanized animals from rescue centers. The data stated that around 6 to 8 million dogs and cats go to rescue shelter every year in the United States from where, the animals are adopted by people. The trend suggests that the adoption of animals has been on the rise in recent years which is augmenting the demand for veterinary services in the United States.

Furthermore, the advanced healthcare industry is helping the veterinary services immensely. For instance, various companies providing diagnostic imaging services for animals are having a strong presence in the country which makes it easier for the owners to get their pet/companion animal diagnosed for certain diseases. Therefore, owing to the above-mentioned factors such as high adoption of pets in the country and presence of top companies, the market studied is expected to grow significantly during the forecast period.

Event Analysis

The COVID-19 pandemic played a role in the increase in pet adoptions. Many people found themselves spending more time at home due to lockdowns and remote work arrangements. This created an opportunity for individuals and families to consider pet adoption since they had more time to care for and bond with a new pet. However, veterinary service providers could not attend their clients properly due to the restrictions associated with the non-emergency procedures. Currently, the market is reaching its pre-pandemic nature in terms of demand for veterinary services and is expected to witness a healthy growth during the forecast period.

You can also buy individual sections of this report.

Would you like to review the price list for each section?

Pricing Analysis

The pricing structure for veterinary services in the United States can vary depending on several factors such as the location, type of practice, level of expertise, and the specific services provided. The average cost of an office visit or consultation typically ranges from USD 50 to USD 100, depending on the location and the veterinarian's expertise. Additionally, the cost of surgical procedures can vary widely depending on the type of surgery, the complexity involved, and the size of the animal. Common surgeries, such as tumor removal or ACL repair, can cost anywhere from USD 500 to several thousand dollars.

Segment Analysis

Based on the Animal Type, the market of Veterinary Services is categorized into Companion Animals and Farm Animals. The trends towards owning a companion animal in the United States has increased since the outbreak of COVID-19. Companion animal services in the United States encompass a wide range of services and resources aimed at the care, well-being, and support of pets and their owners. The veterinary services are customized to address various aspects of pet ownership, including health care, grooming, training, boarding, and more. High adoption of companion animals in the country is accelerating the segment growth. For instance, as per the data from Pet Food Industry Press Release published in January 2023, it was found that In 2022, there were 398,477 dog adoptions, a little rise from the 393,712 dog adoptions in the year prior. This amounts to an increase of about 1.2%. Americans acquired about 2% more cats in 2022 compared to the year before. 528,526 cats were adopted from shelters in 2021; this number increased to 539,015 in 2022. In parallel, fewer dogs and cats were put into shelters in 2021 than in 2022. The statistics indicate that there is a growing adoption of companion animals which is one of the crucial factors responsible for the segment growth in the United States.

To explore in-depth analysis in this report - Request Free Sample Report

Pet insurance is also becoming more widely used around the nation. Health-related costs are covered by pet insurance because the pet is insured. The percentage of all insured companion animals in the United States rose from 23.2% in 2020 to 28.3% in 2021, according to the North American Pet Health Insurance Association (NAPHIA) 2022 study. As there are more insured pets, pet owners are likely to pay more attention to their comfort by giving them the right medications, which will help the segment grow.

Competitive Landscape

Mars, Incorporated, IDEXX Laboratories, Inc, Veterinary Care (Veterinary Practice Partners), Ethos Veterinary Health, PetIQ, LLC, Armor Animal Health, Kremer Veterinary Services, CityVet.

United States Veterinary Services Market, Company Shares Analysis, 2022

To explore in-depth analysis in this report - Request Free Sample Report

Recent Developments:

- In June 2022, In order to provide veterinarians with a comprehensive option for starting their own franchised practice inside PetSmart shops, the pet supply and services giant PetSmart established PetSmart Veterinary Service (PVS). PVS is an independent business ownership model.

- In February 2022, Bond Vet, a chain of walk-in veterinary offices that provides critical and prompt care for cats and dogs, has adopted regional expansion strategy by entering the North-East region of the United States.

The United States Veterinary Services Market is segmented as follows:

By Service Type

- Diagnostic Tests & Imaging

- Physical Health Monitoring

- Others

By Animal Type

- Companion Animal

- Farm Animal

By Care

- Traditional Care

- Emergency Care

Frequently Asked Questions (FAQs)

The global Veterinary Services Market is expected to exceed USD 47.92 Billion by 2035, growing at a CAGR of over 6.29% between 2023 to 2035.

The global Veterinary Services market was valued USD 21.83 Billion in 2022.

Increasing adoption of the pets across the country, growing focus on veterinary healthcare, and presence of the key companies are some of the factors that are driving the market growth for US veterinary services.

Mars, Incorporated, IDEXX Laboratories, Inc, Veterinary Care (Veterinary Practice Partners), Ethos Veterinary Health, PetIQ, LLC, Armor Animal Health, Kremer Veterinary Services, CityVet

Maximize your value and knowledge with our 5 Reports-in-1 Bundle - over 40% off!

Our analysts are ready to help you immediately.